Perform group reporting by tax identification number (TIN) and export a Promoting Interoperability report card by TIN.

Who uses group reporting?

Providers attesting for Comprehensive Care Plan Plus (CPC+)

Requirements

- Only super users can enable group reporting in Administration: Group Reporting.

- All providers must have the same enrollment period and the same program (refer to Administration: EHR Reporting and Quality Measures) selected to get group data for the Promoting Interoperability report card.

- Group reporting is not currently available for the MIPS Dashboard, but can be periodically checked in Report Card Export.

Set Up Group Reporting

- Log in to NextGen® Office as a super user.

- Click Admin.

- Under EHR Setup, click Group Reporting.

- Select the Group Reporting check box.

Export a Promoting Interoperability Report

For instructions on how to export and download a Promoting Interoperability report, refer to Report Card Export.

Assign a Tax Identification Number

Assign a TIN in encounters, prescribed medications, Medication History, Rx Hx, new consult orders, and imported C-CDA files. See Pages Where Tax ID Can Be Added.

Assign a Default Tax ID Number

The TIN selected from the top toolbar designates your default TIN.

- Click

from the top toolbar and select Change Tax ID.

from the top toolbar and select Change Tax ID.

- Select your operating tax ID number.

- Click Save.

The operating tax ID appears next to the provider's name on the top toolbar.

Pages Where Tax ID Can Be Added

To report by tax ID number, you can select your TIN on the following pages.

Note about selecting TIN: If you select a different TIN than your default TIN (that you set from the top toolbar), your selected TIN will override the default TIN for this one selection only. When you open a new encounter, the default TIN will be automatically assigned.

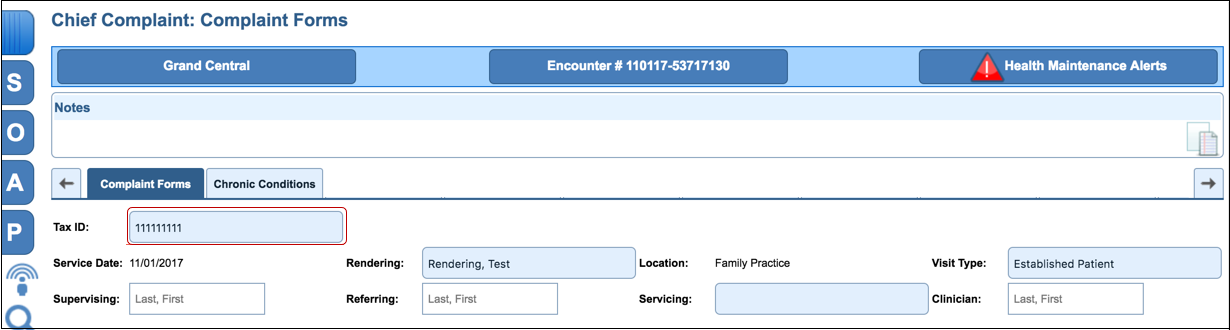

Chief Complaint

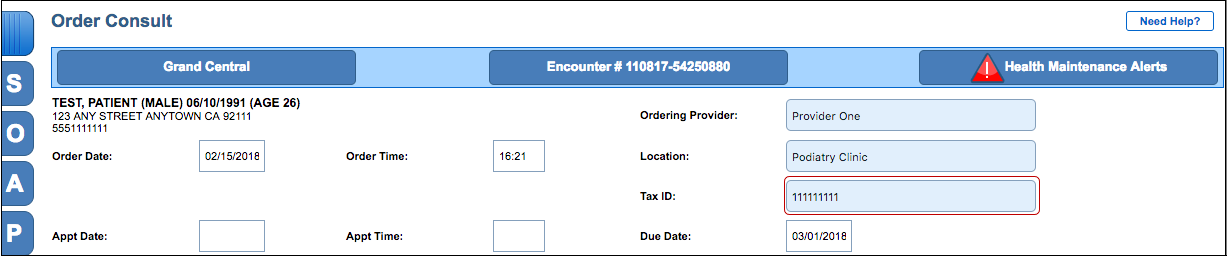

New Consult Orders

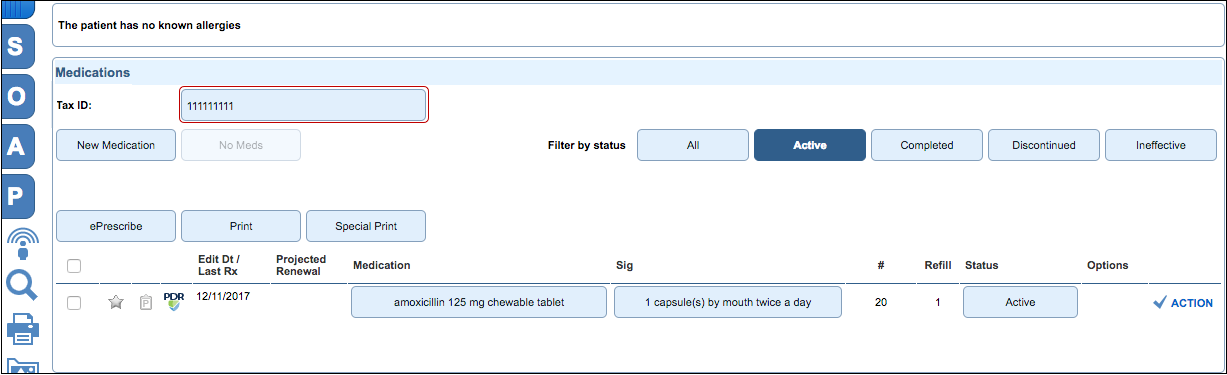

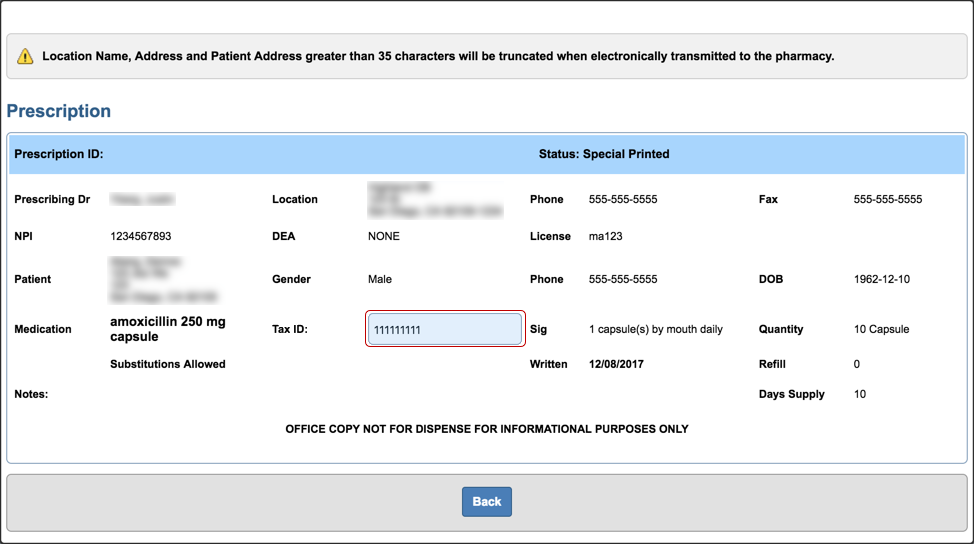

Prescribe

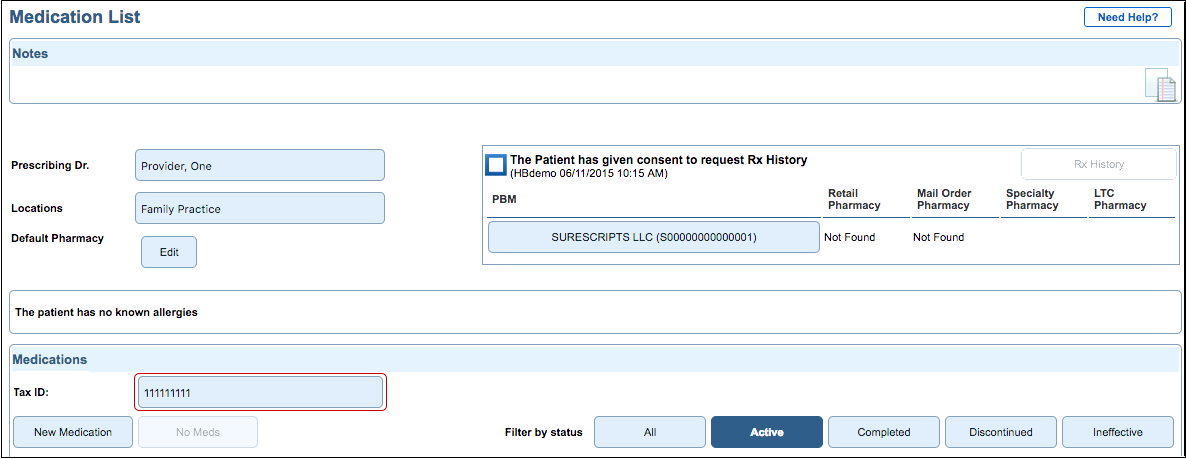

Medication List

RxHx

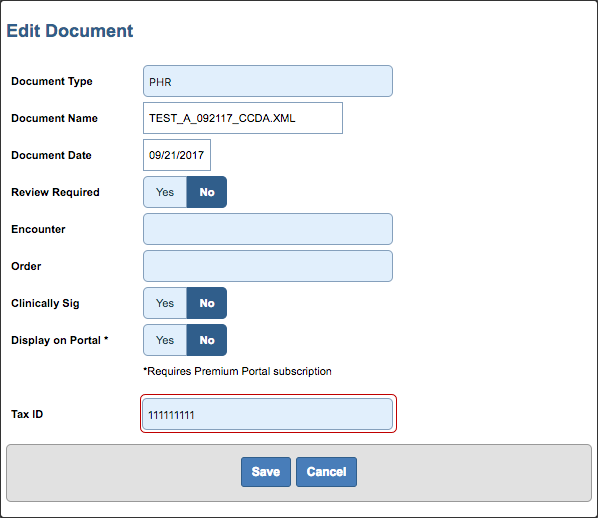

Imported C-CDA Files

See Also:

Administration: EHR Reporting and Quality Measures

Export QRDA I and QRDA III Files

Report Card Export

Last Update: 7/27/25